The impact of tariffs on the US economy has recently become a hot-button issue, especially amid discussions on US trade policy and its implications for American workers. Senator Rick Scott defends the current tariff strategy, viewing it as a necessary measure to ensure a level playing field and combat unfair trade practices. His assertions, particularly regarding China tariffs, emphasize a commitment to supporting domestic industries and reducing trade deficits. However, many economists question this approach, suggesting that tariffs may lead to adverse consequences for the economy and trade overall. As these trade battles unfold, the intricate relationship between tariffs and the economic landscape continues to evoke significant debate among policymakers and the public.

Understanding tariffs’ repercussions on the economic landscape of the United States has never been more critical. Dissecting the ramifications of trade barriers reveals how these policies affect domestic industries and the marketplace. Senator Rick Scott champions the current strategy as essential for uplifting American labor and manufacturing, particularly in the context of competition with nations like China. However, the broader implications of such tariffs raise concerns about inflation, the stability of domestic markets, and the potential for reciprocal penalties from trading partners. As the dialogue evolves, the focus on economic prosperity and equitable trade practices is becoming paramount in shaping the future of US trade relations.

Understanding the Impact of Tariffs on the US Economy

The implementation of tariffs marks a seismic shift in U.S. trade policy, with Senator Rick Scott standing firm in his belief that these tariffs will primarily benefit American workers. The core idea behind the tariffs is to level the playing field for U.S. manufacturers by forcing trading partners to eliminate their own barriers on American goods. This perspective suggests that by making it more difficult for other countries to impose their tariffs, U.S. products will become more competitive globally, ideally leading to increased sales and job creation within the United States.

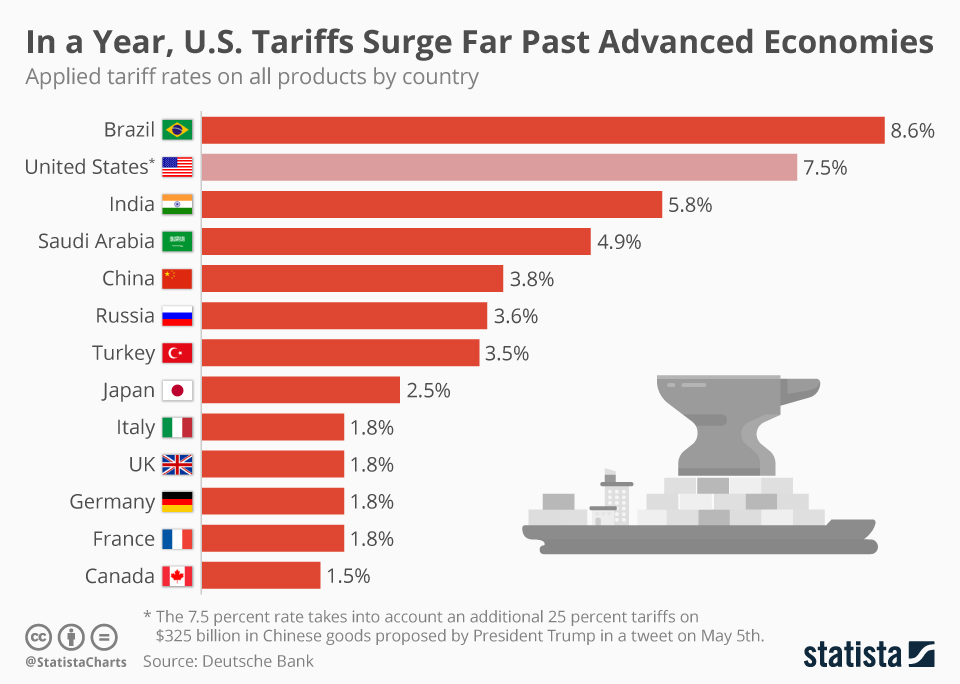

However, the debate surrounding tariffs and their impact on the U.S. economy is multi-faceted. Critics of the tariff strategy argue that the initial disruption to global trade can lead to unintended economic consequences, including market volatility and inflation. The significant rise in American tariffs, particularly against China, has led to retaliatory measures that may end up harming U.S. consumers and businesses. As the Congressional Budget Office warns about rising national debt, the effectiveness of these tariffs in fostering a resilient economy remains a contentious topic among policymakers.

Rick Scott’s Perspective on Tariffs and American Workers

Senator Rick Scott’s staunch advocacy for tariffs is grounded in his commitment to protecting and empowering American workers. He echoes the sentiment that the American workforce deserves a fair opportunity to compete without facing undue disadvantages from foreign competition. Scott argues that eliminating tariff barriers allows U.S. manufacturers to flourish, giving workers the chance to sell more products on a global scale, thereby potentially reducing unemployment and stimulating economic growth.

Nonetheless, Scott’s assertion is met with skepticism by many economists. They question whether imposing tariffs is the best approach to achieving these goals. The potential for domestic inflation and increased costs for consumers are key concerns, with the possibility that the tariffs could backfire instead of bolstering the economy. It raises the question of whether a more diplomatic approach, through negotiation rather than unilateral trade barriers, might produce a more favorable outcome for American workers.

The Rationale Behind Tariffs in US Trade Policy

The rationale for implementing tariffs extends beyond mere economic protectionism; it also reflects a strategic component of U.S. trade policy. Senator Scott, aligning closely with former President Trump’s perspectives, suggests that these tariffs are essential in addressing the long-standing trade imbalances, particularly with China. By significantly increasing tariffs on Chinese imports, the U.S. aims to encourage China to moderate their trade policies and incentivize them to foster a more balanced trade relationship.

However, this aggressive strategy has led to a series of retaliatory tariffs from China, creating a tit-for-tat environment that complicates trade negotiations and enforcement of U.S. policies abroad. As both countries levy tariffs against one another, it becomes increasingly difficult to assess whether this approach yields the intended economic benefits, or if it ultimately hampers trade relations and economic stability.

China Tariffs and Their Consequences on Workers

The exceptional increase in tariffs on goods imported from China has profound implications for U.S. workers. By imposing a staggering 145 percent tariff, the U.S. government seeks to deter reliance on Chinese products, promoting domestic manufacturing instead. Senator Scott argues that reducing trade with a nation he views as a significant competitor is essential for the protection of American jobs and industries. The hope is that by making Chinese products more expensive in the U.S. market, consumers will turn to American-made alternatives.

Yet, the counterpoint made by economists suggests that such drastic tariffs can inadvertently hurt the very workers they aim to protect. Increased tariffs often lead to higher prices for consumers and may decrease demand for certain goods, potentially resulting in job losses within affected industries. The challenge lies in balancing protective measures with the need for a thriving consumer economy that offers affordable products while sustaining the livelihoods of American workers.

Long-Term Effects of Tariffs on the US Economy

Evaluating the long-term effects of tariffs on the U.S. economy presents numerous challenges, as the consequences can take years to fully materialize. The trade policies championed by Senator Scott assert that these tariffs will create a more favorable economic landscape for American workers, and yet the initial impacts can be detrimental, as illustrated by the recent contractions in GDP and market volatility. While the intention behind tariffs is to optimize trade benefits for the U.S., the reality may involve systemic economic shifts that are far from beneficial.

As businesses adjust to the new tariff regime, many may face heightened costs which could lead to downsizing or reduced hiring. While the initial rhetoric emphasizes the protection of American jobs, the ongoing economic environment requires careful monitoring to ensure that tariffs do not lead to higher unemployment rates in sectors directly relying on international trade. Ultimately, the question remains: do the long-term benefits of tariffs outweigh the immediate risks associated with their implementation?

Negotiating Trade: Would Discussions Have Been More Effective?

The conversation about whether tariffs are the most effective means of negotiating trade agreements has gained significant attention. Senator Scott’s stance implies that the imposition of tariffs sends a strong message to countries like China, asserting that the U.S. will no longer tolerate unfair trade practices. However, this approach is met with criticisms concerning the potential fallout from such unilateral decisions. Jason Furman, who participated in discussions with Scott, suggests that diplomatic negotiations could have been a more prudent path, potentially averting economic instability.

Negotiating trade tariffs offers the potential for collaborative solutions that benefit both parties involved, avoiding the ill effects of a trade war. It raises the question of whether a more measured approach, involving discussions and compromises rather than immediate economic sanctions, might lead to a more sustainable and mutually beneficial trade environment. As the situation continues to unfold, assessing the effectiveness of tariffs versus negotiations will remain an important factor in understanding the future direction of U.S. trade policy.

Potential Inflation Concerns Linked to Tariffs

Inflationary pressures are a significant concern in the context of the recently imposed tariffs, as highlighted by Senator Scott’s uncertainty on the topic. Rising tariffs on imported goods can lead to increased prices for consumers, creating a ripple effect across the economy. Many economists warn that tariffs can cause inflation because businesses facing higher import costs may pass those expenses onto consumers, thereby decreasing purchasing power and overall economic growth.

Scott’s acknowledgment of the relationship between tariffs and inflation underscores a critical dilemma for U.S. policymakers: balancing protective measures for American workers while safeguarding consumer interests. If tariffs lead to widespread inflation, it could negate the intended benefits of safeguarding domestic industries and workers. Policymakers must carefully examine the interplay between tariffs, inflation, and their broader economic impact to ensure that any benefits are not offset by rising costs of living.

Rick Scott’s Broader Economic Perspectives

Beyond just tariffs, Senator Rick Scott articulates a broader vision for U.S. economic stability, emphasizing the importance of fiscal responsibility. His advocacy for balanced budgets and reduced government spending underscores a belief that sound economic practices are essential for the nation’s financial health. By addressing national debt concerns and promoting a balanced approach to economic growth, Scott aims to fortify the U.S. economy against potential shocks induced by tariff policies.

This comprehensive view suggests that tariffs should not be seen in isolation; rather, they are part of a wider strategy that includes maintaining fiscal discipline. The intersections between trade policy and fiscal responsibility highlight the complexity of managing a thriving economy in today’s interconnected global market. By prioritizing both responsible budgetary practices and protective trade measures, Scott envisions an environment where U.S. businesses can grow and compete effectively.

Future of US Trade Policy under Changing Circumstances

As the landscape of global trade continues to evolve, the future of U.S. trade policy remains uncertain. Senator Scott’s determined stance on tariffs illustrates a commitment to an aggressive trade strategy, yet the challenges posed by retaliatory actions from other nations, including China, complicate this approach. What the future holds for U.S. trade policy is contingent on a variety of factors, including economic performance, shifting international relations, and the ongoing dialogue regarding tariffs and trade agreements.

Ultimately, adapting trade policies to either reinforce or mitigate the impacts of existing tariffs could dictate the trajectory of U.S. economic growth. As challenges arise, the ability of policymakers to negotiate effectively will be vital. The potential for finding common ground with trade partners, while addressing domestic pressures from American workers and industries, is a complex balancing act that will require nuanced strategies moving forward.

Frequently Asked Questions

How will Rick Scott’s tariffs impact the US economy?

Rick Scott argues that the implementation of tariffs will level the playing field for American workers by reducing competition from foreign products. He believes that by urging countries to lower their tariffs on US goods, American manufacturers will see increased sales and productivity. However, the overall impact of these tariffs on the US economy remains a point of contention among economists.

What is the significance of US trade policy in relation to tariffs?

US trade policy, particularly under the Trump administration, emphasizes the use of tariffs as a tool to negotiate better terms with trading partners and protect American jobs. Rick Scott’s support of a robust tariff framework aims to incentivize countries like China to reduce their trade barriers, ultimately enhancing opportunities for US workers, though many economists warn of potential negative consequences for the economy.

What are the China tariffs and their impact on the US economy?

China tariffs, particularly the high rates imposed during the recent trade policies, are designed to protect American industries from unfair competition. However, these tariffs, which reach as high as 145%, have sparked trade tensions and retaliatory measures, such as China imposing tariffs on US imports. The impact of these tariffs on the US economy includes potential short-term gains for specific sectors but raises concerns about inflation and a possible slowdown in economic growth.

What are the implications of tariffs on workers in the US economy?

The impact of tariffs on workers in the US economy is complex. Proponents like Rick Scott believe that tariffs will benefit American workers by supporting domestic production and job creation. Critics, however, warn that increased tariffs can lead to higher prices for consumers, potentially causing job losses in industries reliant on imported goods. This dual effect raises important questions about the true benefits versus the costs of such trade policies.

In what ways could the impact of tariffs on the US economy be mitigated?

Mitigating the impact of tariffs on the US economy could involve pursuing comprehensive trade agreements that encourage dialogue with trading partners. Senator Rick Scott suggests individual agreements might be beneficial, but economists like Jason Furman argue that negotiating terms before imposing tariffs could preserve economic stability and minimize risks associated with trade wars.

How did the global stock market react to the changes in US tariffs?

The global stock market experienced volatility following the announcement of new tariffs by the US government. This reaction indicates investor concern regarding potential economic downturns linked to escalating trade tensions. The $6 trillion loss in market value during the early tariff implementation period highlights the uncertainty surrounding the long-term implications of such trade policies on the US economy.

What does Rick Scott believe about trade with China and its economic implications?

Rick Scott firmly believes that the US should engage in no trade with China, asserting that the best way to prevent military conflict is through weakening China’s economy. His perspective illustrates the broader implications of tariffs as a means to exert economic pressure, raising questions about the direction of US-China relations and its impact on global economic stability.

| Key Point | Details |

|---|---|

| Tariff Strategy | Senator Rick Scott defends Trump’s tariff strategy aimed at urging other countries to reduce their tariffs on American products. |

| Impact on Workers | Scott believes tariffs will empower American workers to sell more products internationally without barriers. |

| China’s Role | Scott views China as a significant competitor, advocating for no trade with the country to avoid potential war. |

| Economic Ramifications | Tariffs have led to volatility in global stock markets and are partially blamed for GDP contraction in the first quarter. |

| Opposing Views | Many economists, including Jason Furman, argue that Trump’s tariff policy could harm the U.S. economy. |

| Tariff Rates | The U.S. has imposed a 10% tariff on most countries, while China faces a 145% tariff. |

| National Debt Concerns | Scott emphasizes the need for a balanced budget and reduced spending to avoid worsening the national debt. |

| Inflation Uncertainty | Scott is uncertain about the impacts of tariffs on inflation, suggesting a balanced budget may stabilize prices. |

Summary

The tariffs impact on the US economy is a contentious issue, with differing opinions on their effectiveness. While Senator Rick Scott argues that tariffs will level the playing field for American workers and reduce foreign competition, critics, including economists like Jason Furman, suggest that these measures could lead to economic downturns and stock market volatility. Ultimately, the long-term effects of these tariffs will require careful analysis, particularly concerning inflation rates and the national debt.