Stefanie Stantcheva, an acclaimed Harvard economist, has recently earned the prestigious John Bates Clark Medal for her exceptional contributions to the field of economics before the age of 40. Recognized for her pioneering research on tax policy, innovation, and economic behavior, Stantcheva continues to influence the academic community with her insights. Her work critically examines how tax systems can drive or hinder innovation, providing a foundation for understanding broader social economics. During a recent celebration, she expressed gratitude for the acknowledgment, highlighting the importance of public finance in shaping economic landscapes. With her leadership at the Social Economics Lab, Stantcheva is dedicated to exploring the intersections of policy and human behavior, promising to reshape discussions around economic policy moving forward.

In recent years, the realm of economic inquiry has seen a wave of dynamic scholars making significant impacts. Among these emerging voices is Stefanie Stantcheva, a Harvard economist recognized for her inventive approaches to understanding tax systems and their influence on societal advancement. As a recipient of the esteemed John Bates Clark Medal, she exemplifies the next generation of economists shaping our comprehension of fiscal issues and public policy. Stantcheva’s research goes beyond traditional economic theories, delving into nuanced interactions between individuals and their economic environments. By focusing on how emotions and societal perceptions influence economic policies, she unlocks vital insights crucial for nurturing innovation and improving social welfare.

Stefanie Stantcheva: A New Voice in Economic Thought

Stefanie Stantcheva, celebrated for her profound insights into tax policy, embodies the innovative spirit of modern economic research. As the Nathaniel Ropes Professor of Political Economy at Harvard University, her achievements notably include being awarded the John Bates Clark Medal. This prestigious accolade, presented by the American Economic Association, recognizes the contributions of economists under the age of 40. Through her work, Stantcheva has dramatically influenced how we perceive the relationship between tax systems and innovation, challenging traditional notions about fiscal policies and their implications on economic behavior.

Stantcheva’s research transcends mere statistical analysis; it delves into the fabric of social economics, examining how tax policies can both incentivize and inhibit progress. Her landmark paper, “Taxation and Innovation in the 20th Century,” sheds light on the adaptability of innovation to the shifting landscape of tax regulations. Co-authored with leading figures in the field, the study finds that the elasticity of innovation is significantly influenced by taxation, a revelation that has profound implications for policymakers aiming to foster economic dynamism.

The Impact of Tax Policy on Economic Behavior

Tax policy plays a critical role in shaping economic behavior, acting as a catalyst or deterrent for innovation and productivity. Stantcheva has highlighted that a well-structured tax system can stimulate economic activity by promoting creative endeavors and enhancing overall societal welfare. Conversely, poorly designed tax frameworks may stifle innovation and lead to reduced economic output. This duality indicates that effective tax policy must consider the behavioral responses of individuals and firms, illustrating the need for nuanced fiscal strategies.

Research in the field of social economics emphasizes the importance of understanding how individuals respond to taxation. Stantcheva’s pioneering work demonstrates that the emotional and psychological factors surrounding tax policy can significantly impact public perception and compliance. By addressing these behavioral aspects, economists can design better tax systems that not only foster innovation but also maintain public trust within the socioeconomic landscape.

Exploring these themes, economists gain critical insights into how taxation intricately intertwines with public finance and economic outcomes. As Stefanie Stantcheva continues her groundbreaking research, her findings remain pivotal for shaping future discussions on tax policy and its broader implications.

The John Bates Clark Medal: Recognizing Excellence in Economics

The John Bates Clark Medal is among the highest honors in the field of economics, awarded annually to a promising economist under the age of 40 who has contributed significantly to economic thought. Named after the influential American economist John Bates Clark, the award serves to highlight the innovative work being done by rising stars in economics. Recipients of this accolade are celebrated not only for their academic achievements but also for their potential to influence the future of economic policy and research.

Stefanie Stantcheva’s selection as the 2025 winner of this prestigious medal speaks volumes about her influence and contributions to economic discourse. Her extensive research on tax policy and innovation aligns perfectly with the medal’s vision of recognizing transformative ideas that affect real-world economic conditions. As Stantcheva continues to push the boundaries of economic research, her recognition serves to inspire upcoming generations of economists to challenge existing paradigms and contribute new ideas to the field.

Innovation and Its Relationship with Taxation

Innovation is a cornerstone of economic growth, and understanding its relationship with taxation is crucial for policymakers. Stefanie Stantcheva’s research brings clarity to this connection, illustrating how different tax regimes can result in varying levels of innovation output. Her work emphasizes that while higher taxes may discourage the total quantity of innovations, they do not necessarily detract from the quality of inventions produced. This nuanced understanding is vital for constructing tax policies that encourage not just more inventions, but also better ones.

Furthermore, the elasticity of innovation in response to changes in tax policy underscores the adaptability of the economy. As Stantcheva points out, when taxes are adjusted, firms and entrepreneurs often recalibrate their strategies in order to maximize their post-tax returns, emphasizing the need for dynamic tax structures. Policymakers must consider these responses when crafting tax regulations to ensure they are not inadvertently stifling the very innovation that drives economic progress.

Social Economics Lab: A Hub for Innovative Research

Founded by Stefanie Stantcheva, the Social Economics Lab serves as a beacon for interdisciplinary research that merges economic theory with real-world applications. Since its inception in 2018, the lab has focused on examining how individuals perceive and respond to economic policies, particularly in areas such as immigration, climate change, and social mobility. By exploring the intersections of economics and social behavior, the lab aims to generate actionable insights that can inform policymakers and enhance public welfare.

The lab’s ongoing projects are genuinely cutting-edge, blending behavioral economics with social psychology to delve deeper into critical issues affecting today’s society. Stantcheva’s commitment to understanding the emotional underpinnings of economic decision-making reflects a growing recognition of the importance of human behavior in shaping economic outcomes. This innovative approach not only enriches the academic landscape but also presents an opportunity for tangible improvements in public policy.

Understanding Economic Behavior through Tax Policy Research

Economic behavior is shaped by a multitude of factors, including tax policy, that can influence individuals’ decisions and actions. Through her extensive research, Stefanie Stantcheva has contributed significantly to understanding these dynamics, revealing how different tax structures can alter behavior at both individual and collective levels. Her work confirms that tax policy is not merely a fiscal tool but a determinant of how people engage in economic activities, from entrepreneurship to investment.

In exploring the implications of tax policy on innovation, Stantcheva highlights the delicate balance that exists between taxation and economic productivity. Policymakers must navigate the complexities of economic behavior to design effective tax systems that encourage innovation while also providing necessary public goods. Her findings underscore the importance of continuous research in this area, as shifts in tax policy can yield complex and often unforeseen reactions from economic actors.

Harvard Economics: A Legacy of Excellence

Harvard University has long been recognized as a bastion of economic research and academic excellence. The Economics Department is home to some of the brightest minds in the field, including past winners of the John Bates Clark Medal. Celebrating Stefanie Stantcheva’s achievement is not only a recognition of her contributions but also a testament to the department’s continued influence in shaping contemporary economic discourse.

The collaborative environment at Harvard encourages innovative thinking and the cross-pollination of ideas, allowing scholars like Stantcheva to thrive. With her focus on tax policy and its implications for economic behavior, she exemplifies the department’s commitment to addressing pressing economic challenges through rigorous research. As Harvard economics continues to evolve, it remains pivotal in training future economists who will tackle the complex issues facing our society.

Emotional Dynamics in Economic Decision-Making

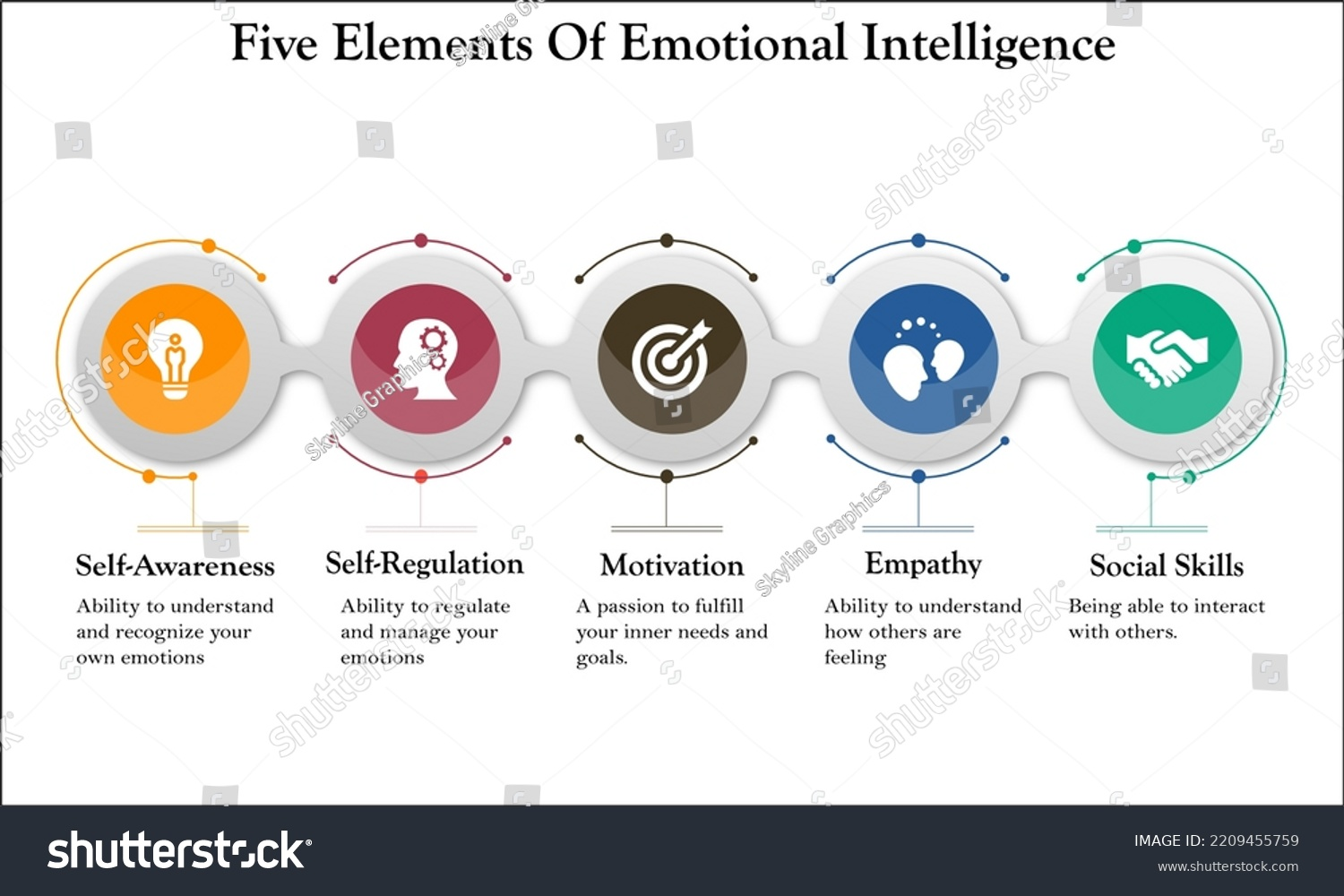

Recent studies have shown that emotions play a significant role in economic decision-making, an area that Stefanie Stantcheva is keen to explore within her research. Understanding how emotional responses can influence perceptions of economic policies is essential for creating effective interventions. Her interest in the interplay between emotions and economic behavior promises to unveil new insights into how people approach issues like taxation, innovation, and public services.

By addressing these emotional dynamics, the Social Economics Lab aims to bridge the gap between abstract economic theories and real-world applications. Stantcheva’s focus on bringing human emotions into the forefront of economic discussions highlights a transformative perspective that can lead to more empathetic and effective policy-making. As this research unfolds, it is likely to reshape how economists view the motivations behind economic choices.

Future Directions in Tax Policy Research

The landscape of tax policy is constantly shifting, influenced by economic trends, political decisions, and global challenges. As new research emerges, economists like Stefanie Stantcheva are at the forefront of examining how these changes impact innovation and economic behavior. Her ongoing work continues to explore critical questions about the efficacy of current tax mechanisms and their ability to adapt to evolving economic realities.

Looking ahead, the future of tax policy research will likely involve deeper investigations into the long-term effects of taxation on innovation across different sectors. Stantcheva’s insights into the quality versus quantity of innovation produced under various tax regimes could provide invaluable guidance for policymakers aiming to foster a sustainable and thriving economic environment. This research is vital for aligning tax policy with broader objectives of social equity and economic growth.

Frequently Asked Questions

What contributions has Stefanie Stantcheva made to tax policy research?

Stefanie Stantcheva, a Harvard economist and winner of the John Bates Clark Medal, has made significant contributions to tax policy research, particularly in understanding how tax systems influence economic behavior and innovation. Her research reveals the high elasticity of innovation in response to changes in tax policy, indicating that well-designed tax systems can foster innovation and economic growth.

Why was Stefanie Stantcheva awarded the John Bates Clark Medal?

Stefanie Stantcheva received the John Bates Clark Medal in 2025 for her pioneering insights into tax policy, innovation, and economic behavior. The award honors her significant contributions as an under-40 economist, especially her work demonstrated in her paper “Taxation and Innovation in the 20th Century,” which discusses the adverse effects of higher taxes on the quantity of innovation.

How does Stefanie Stantcheva’s research impact social economics?

Stefanie Stantcheva’s research significantly impacts social economics by examining the relationship between tax policy and economic behavior. Her findings highlight how economic policies can shape societal outcomes, thus informing public finance discussions and interventions aimed at enhancing social mobility and addressing issues such as trade and immigration.

What is the Social Economics Lab founded by Stefanie Stantcheva?

The Social Economics Lab, founded by Stefanie Stantcheva in 2018, focuses on understanding economic behavior and the public’s perception of economic policies. The lab conducts research exploring diverse areas, including emotions in decision-making and mindsets like zero-sum thinking, aiming to produce insights that can inform effective economic policy.

What are some key themes in Stefanie Stantcheva’s research?

Key themes in Stefanie Stantcheva’s research include tax policy’s effect on economic behavior, innovation elasticity in response to taxation, and the interplay of emotions and economic decision-making. Her work addresses important contemporary issues such as climate change, immigration, and social mobility within the framework of social economics.

In what ways does tax policy influence innovation according to Stefanie Stantcheva’s findings?

According to Stefanie Stantcheva’s findings, tax policy significantly influences innovation by demonstrating high elasticity—meaning that changes in tax rates can lead to corresponding changes in innovative activity. Though higher taxes generally reduce the quantity of innovations produced, they do not necessarily diminish the quality of those innovations, highlighting the complexities of tax policy design.

What recognition has Stefanie Stantcheva received in the field of economics?

Stefanie Stantcheva has received notable recognition, including the prestigious John Bates Clark Medal awarded in 2025 for her impactful research in economics as a Harvard economist. This honor celebrates her substantial contributions to the understanding of tax policy and its implications for economic behavior and innovation.

| Key Point | Details |

|---|---|

| Award Recognition | Stefanie Stantcheva received the 2025 John Bates Clark Medal, recognizing her contributions to economics. |

| Pioneering Insights | Stantcheva is noted for her work on tax policy, innovation, and economic behavior. |

| Research Impact | Her research shows that the tax system can significantly influence economic activity. |

| Elasticity of Innovation | A study demonstrated that innovation reacts to tax policy changes with high elasticity. |

| Current Work | She is investigating topics at the Social Economics Lab, including emotions in policy. |

| Future Goals | Stantcheva aims to deepen understanding of how people perceive economic issues. |

Summary

Stefanie Stantcheva stands out as a prominent figure in the economics field, recently earning the prestigious John Bates Clark Medal for her groundbreaking insights into tax policy and its implications for innovation. Her work highlights the intricate relationship between tax systems and economic behavior, demonstrating that thoughtful tax design can foster innovation rather than hinder it. Looking forward, Stantcheva’s commitment to exploring the nexus of economics and human emotions through her Social Economics Lab promises to yield important insights, further enhancing her impact on economic policy and public finance.